Probably, there are no country with opened economy in the world, which has not suffered from financial crisis. Troubles about solvency of the biggest financial institutions of U.S.A. and Europe push the world financial system to systematic collapse.

British Prime Minister Gordon Brown and Chancellor of the Exchequer Alistair Darling ask parliament to adopt £500 billion bailout for the British banking system.

Lame duck U.S. President George W. Bush held an Oct. 11 meeting with finance ministers of G7, as well as with heads of the IMF and World Bank. At the end of the meeting, Bush said that all its members recognize the seriousness of the current crisis, and that the global crisis requires a global response. The challenge is that the actions of one country do not run or do not undermine the actions of another.

U.S. Treasury Henry Paulson.

George W. Bush and Henry Paulson after the U.S. Congress from the second attempt passed bill on the redemption the country’s financial system over 700 billion dollars owed to American taxpayers.

Protests spread to the United States of the people, who oppose the proposed White House plan of support of financial sector, which will cost the budget in the amount of $ 700 billion.

Women’s anti-war activists and human rights organization «Code Pink» defend the interests of ordinary

taxpayers.

PR-action of organization «Barely Political» outside the New York Stock Exchange.

German Chancellor Angela Merkel.

Right to left: British Prime Minister Gordon Brown, French President Nicolas Sarkozy, Italian Prime Minister Silvio Berlusconi and German Chancellor Angela Merkel.

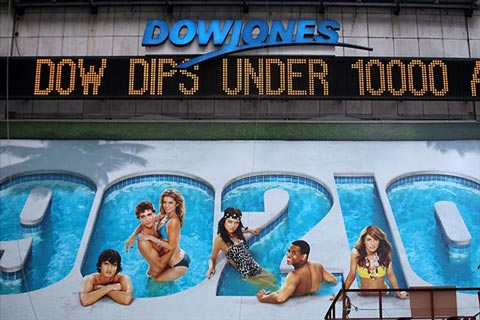

At October 6 index of Dow Jones for the first time in four years dropped below 10,000 points.

New York Stock Exchange.

New York Exchange (NYSE).

According to the latest data, the U.S. owed more than 10 trillion 200 billion dollars.

The electronic scoreboard at the heart of New York was not prepared for the current level of public debt of United States. Killing figures don’t fit the screen.

The Russian business newspaper «Kommersant»: «The market beaten down to the bottom».

Since the beginning of the financial crisis the richest Russians have lost a total of $ 230 billion or 52% its capital. These are the outcome of the crisis in the financial projections for the state of Russian billionaires.

Russian President Dmitry Medvedev and Chairman of the Supervisory Board «Alfa Group» Mikhail Fridman.

There is information about the imposition of economic censorship on public television, which allegedly banned on-air mention the word «crisis» and «collapse». None of the three major Russian channels – Channel One, Russia and NTV did not report record 19-percent fall in Russian stocks on Monday October 6. Instead, they talked about meeting of President Medvedev and Mikhail Friedman, during which were discussed opportunities that have arisen for Russian companies in connection with the global financial crisis.

During a recent visit to the Magadan region Dmitry Medvedev got acquainted with the production of gold and silver ingots at Kolymsky Affinazhny plant and an exhibition of Magadan Local History Museum.

«Gold necessary to show – especially at a time when people raise some doubts!», – Said Medvedev, convinced that for market word is gold.

Dubai Stock Exchange.

Brazilian Mercantile & Futures Exchange (BM&F).

Panic on Sao Paolo Exchange.

Frankfurt Stock Exchange.

Frankfurt Stock Exchange (FSE).

Stock Exchange Jakarta, Indonesia.

The work of the Jakarta Stock Exchange was suspended on Wednesday after the index fell more than 10% – up to the lowest in the past three years level.

Jakarta Stock Exchange (JSE).

Stock Exchange of Malaysia – Kuala Lumpur Stock Exchange.

Kuwait Stock Exchange.

Kuwait Stock Exchange (KWE).

The protest outside the bank Lloyd’s TSB in London.

London Stock Exchange (LSE).

Madrid Stock Exchange (Bolsas y Mercados Espanoles).

Remelting of various ornaments made of gold in gold bullion at gauging the Austrian factory Ogussa GmbH.

Due to the fact that the end of the financial crisis had not yet seen the European man in the street prefer to invest finance in traditional values such as, for example, gold.

Moreover, there is unprecedented rise in the prices of precious metals. At the New York Stock Exchange price for troy ounce reached $ 888, very close to the psychological mark of $ 900.

According to German media, orders for manufacturing products made of gold has taken a month in advance. Gold ingots are also bought, a deficit of which has already affected.

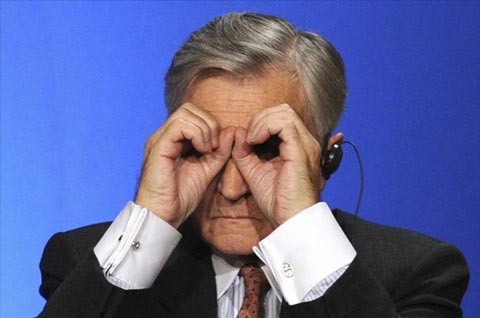

The head of the European Central Bank Jean-Claude Trichet.

European Central Bank President Jean-Claude Trichet called on market participants to calm down and said that European Central Bank is ready to provide market liquidity for as long as necessary.

Italian Prime Minister Silvio Berlusconi.

The Tokyo Stock Exchange.

Tokyo Stock Exchange (TSE).

Photos: Reuters, AFP, AP.

<Angela Merkel, Banks, Brazil, Bush, Business, Dmitry Medvedev, Dow Jones, Dubai, Europe, European Central Bank, Finance, Financial Crisis, Frankfurt, George W. Bush, Gold, Gordon Brown, Henry Paulson, IMF, Italy, Jean-Claude Trichet, Kuwait, London, Madrid, Malaysia, New York, Nicolas Sarkozy, Politics, President, Russia, Silvio Berlusconi, Stock Exchange, Tax, Taxpayer, Tokyo, U.S. Congress, U.S. President, US, World Bank |

« Obama mania in the world | Main | Fighting politicians in different countries »